January is the season for New Year’s resolutions. But can that be applied to accounting and company management? Of course it can! We have compiled a list of handy tips…

Category: Business

Personal income tax waived for those under 25 in Hungary

Starting from 2022, people under 25 do not pay personal income tax in Hungary. The new regulation aims at making the employment of young people more attractive to employers, while…

KATA and flat-rate taxation in Hungary in 2022

Last updated on 21 December 2021. In Hungary, many favorable taxation options are available to small companies and entrepreneurs, depending on the size and type of their business. KATA and…

Social contribution tax decrease in Hungary

Alongside the next increase to the minimum wage just announced for 2022, social contribution tax will be decreased to even out the financial burden on employers. This way minimum wage…

Worldwide inflation due to the pandemic expected to decrease in 2022

The ongoing coronavirus pandemic has had dire effects on world economy, creating bottlenecks in supply chains, rearranging the labor market, and increasing inflation, with the effects expected to be felt…

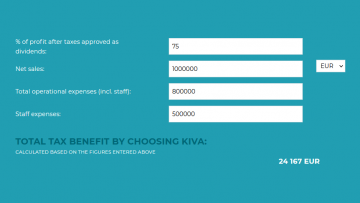

Explore the new small business tax calculator

Every newly registered company in Hungary must choose a tax regime. Is the regular corporate tax or KIVA more beneficial for your company? Check out our new small business tax…