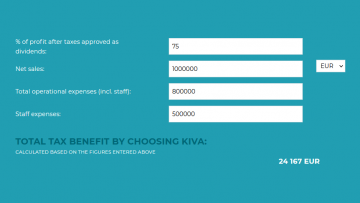

Every newly registered company in Hungary must choose a tax regime. Is the regular corporate tax or KIVA more beneficial for your company? Check out our new small business tax…

Category: Accountancy

Accounting for the climate crisis

Climate change is happening. But what does accountancy do with mitigating its effects? Accountants are skilled at creating reports and projections, and they can help managers and investors make decisions…

AI and automation in accounting

Automation in accounting, just in any other fields, aims at removing simple and repetitive tasks from the workload of specialists, so they can focus on tasks that require more expertise…

Outsourced accounting vs. in-house accounting

Start-ups and SMEs usually have outsourced accounting. But what are the main benefits, and when does it makes sense to have accountancy in-house instead? There are three main factors to…

Local business tax: how much do you need to pay?

At 9%, Hungarian corporate tax is one of the lowest in the European Union. However, depending on its registered seat, your Hungarian company will very likely to pay local business…

Invoicing in Hungary: e-invoice, PDF, or paper invoice?

If you run a business, you are probably familiar with the basics of invoicing and know what to write on an invoice. But are e-invoices, PDF invoices or paper invoices…