Starting from the middle of November 2023, wine products sold by vineyards will be exempt from representation tax in Hungary. The decision is expected to give a boost to the…

Category: Accountancy

Hungarian pension tax records accessible online

As part of the electronic administration in Hungary, personal pension tax records are available for review online. With your Ügyfélkapu access, you can log in to the database of the…

Hungarian Tax Authority conducts more tax inspections

The number of yearly tax inspections conducted by the Hungarian Tax Authority has been steadily increasing over the past few years. The most popular tax inspected continues to be VAT,…

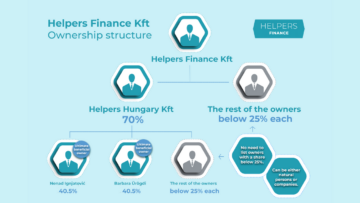

How to present the ownership structure of your Hungarian company?

You are required to present the ownership structure of your newly created Hungarian company when you are registering it for various services. This is easiest done in the form of…

What are the advantages of opening a securities account?

Money left on a regular bank account pays hardly any interests, while making investments through a securities account can even increase their value, especially in a high inflation environment like…

Summer is the season for temporary work – make sure to declare it

Whether it is because of increased turnover or employees taking their holidays, your business might be in need of temporary workers. You have various options, just make sure to declare…