We have already discussed plans for the introduction of a global minimum tax. Last week, Hungary agreed to join the convention that aims to set corporate tax at a 15%…

Category: Taxes

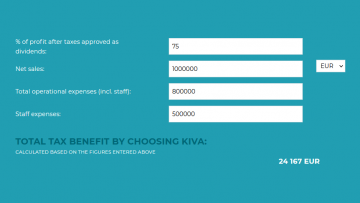

Explore the new small business tax calculator

Every newly registered company in Hungary must choose a tax regime. Is the regular corporate tax or KIVA more beneficial for your company? Check out our new small business tax…

Local business tax: how much do you need to pay?

At 9%, Hungarian corporate tax is one of the lowest in the European Union. However, depending on its registered seat, your Hungarian company will very likely to pay local business…

Issuing invoices in Hungary: reverse charge on VAT

Most business owners in Hungary are used to issuing and receiving invoices with value-added tax. When such an invoice is issued, the buyer must pay the gross amount, and later…

Make sure to pay the BKIK contribution for 2021

If you have a business in Hungary, you may have received an e-mail from the Budapest Chamber of Commerce (BKIK) about your yearly contribution. This is a fee that all…

Selling services – when to charge VAT?

Whether your services are subject to VAT depends on who your customers are and where they are located. Since the applicable VAT rate also depends on the kind of services…