Last updated on 2 May 2022.

Every newly registered company in Hungary must choose a tax regime. Is the regular corporate tax or KIVA more beneficial for your company? Check out our new small business tax calculator, and let us help you make an informed decision.

Taxation options for small businesses

Small businesses have basically two options when it comes to taxation regimes. One is the “regular” tax regime (called TAO), where corporate tax is 9%, but you must also consider various other expenses, like the payroll tax of employees. The other one is KIVA (short for “small business tax” in Hungarian), where instead of the corporate tax and the payroll taxes, you pay a 10% tax.

10% sounds more than 9%, so what is the deal, then? Well, first of all, the tax base is different. While TAO is paid after your profits, the tax base of KIVA is the sum of the dividend you take, the balance of capital changes, and the personnel related expenses (usually the gross salary of your employees).

Accordingly, KIVA is most beneficial for companies with high profitability, low staff expenses, and low dividend payments. This is typical for businesses that provide services, where the value is created by the employees but not in the form of tangible goods. Typical examples are software development or consultancy. If your company profile is different, you might be better off with TAO, even if your company qualifies as a small business.

Small business tax for small businesses

Since KIVA is literally a small business tax, you can choose this tax regime only if the revenue, the balance sheet, and the headcount of your Hungarian company remains under a certain limit. While you are small, however, you can continue to take advantage of the option more favorable to you. And which one is that?

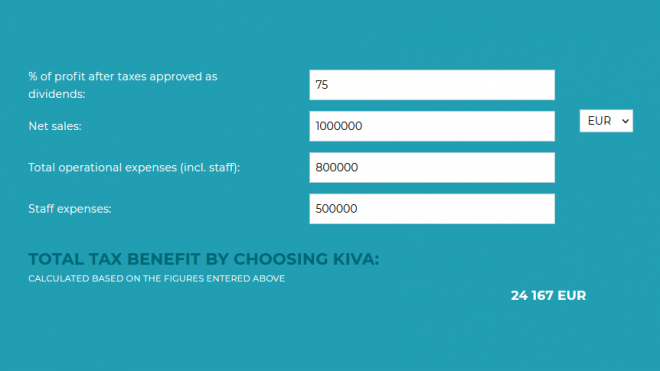

Check out our calculator to see for yourself!

Even before registering your company, you might already have some ideas about your expected costs and revenues. Just enter your data in our small business tax calculator, and see the results for yourself.