Most Hungarian small and medium sized companies do not need an auditor. However, when they grow to a certain size, they will be required by law to hire an auditor…

Tag: Compliance

Hungarian Tax Authority conducts more tax inspections

The number of yearly tax inspections conducted by the Hungarian Tax Authority has been steadily increasing over the past few years. The most popular tax inspected continues to be VAT,…

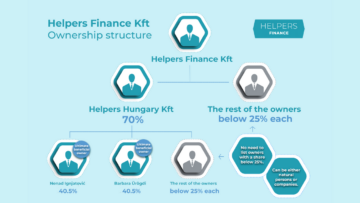

How to present the ownership structure of your Hungarian company?

You are required to present the ownership structure of your newly created Hungarian company when you are registering it for various services. This is easiest done in the form of…

Summer is the season for temporary work – make sure to declare it

Whether it is because of increased turnover or employees taking their holidays, your business might be in need of temporary workers. You have various options, just make sure to declare…

Tax payment notices urging businesses to clear their debts

The Hungarian Tax Authority is now sending notices to businesses if the payments they made for 2022 do not match the amount they were supposed to pay, whether they are…

Hungarian tax residents are responsible for declaring correct data

Recently, the Hungarian Tax Authority has published a press release to remind everyone that Hungarian tax residents must be aware if their income generated abroad is taxable in Hungary too.…