When you have funds in excess, it is usually best not to just let them lie around in your pocket or on a bank account, but to make some kind…

Category: Business

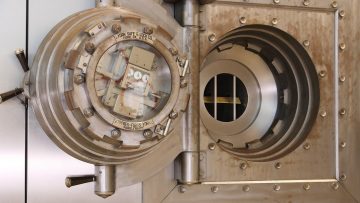

Sberbank liquidation and OBA deposit insurance

As a fallout of the current war between Ukraine and Russia, the Central Bank of Hungary (Magyar Nemzeti Bank or MNB) has recently announced that Sberbank Hungary will be liquidated.…

What is happening to the Hungarian HUF bank accounts of Revolut?

Despite recent rumors, Revolut is not moving out of Hungary. However, Revolut’s Hungarian HUF bank account is being cancelled as of 1 April 2022, which is most relevant for employers…

How a conflict between Ukraine and Russia can affect business in Europe

Currently, tension is growing on the border of Ukraine and Russia. Whether or not it will develop into a military confrontation, the situation is likely to affect economy in Europe…

Debt collection in Hungary: the full picture

When doing business, you expect your partners to pay for your services, or provide the products you have paid for on time. However, sometimes life happens, and your company ends…

Price cap for basic foods introduced in Hungary for three months

Last updated on 30 June 2023. Because of the soaring inflation, Hungary has announced the introduction of a price cap for a handful of basic foods. The price control will…