How to present the ownership structure of your Hungarian company?

Transparency is a key value in the European Union. In line with this, and to comply with anti-money laundering regulations, you are required to present the ownership structure of your newly created Hungarian company when you are registering it for various services. This is easiest done in the form of a chart that starts with your Hungarian company and ends in the ultimate beneficial owners.

Transparency is a key value in the European Union. In line with this, and to comply with anti-money laundering regulations, you are required to present the ownership structure of your newly created Hungarian company when you are registering it for various services. This is easiest done in the form of a chart that starts with your Hungarian company and ends in the ultimate beneficial owners.

Ownership structure

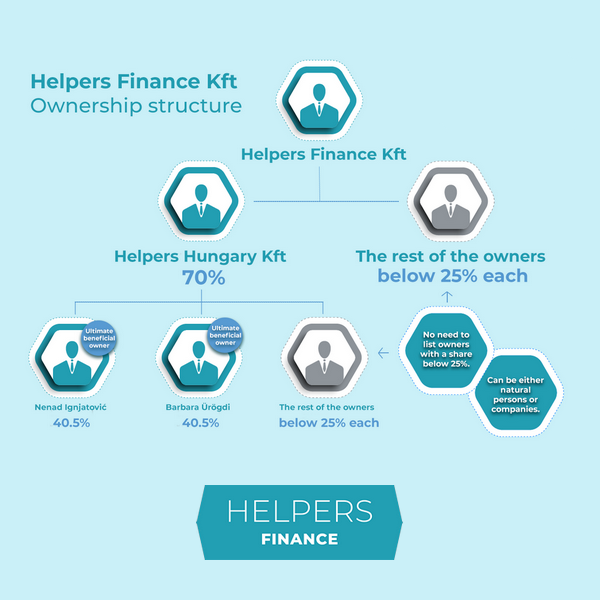

The ownership structure of your Hungarian company is much like a family tree. It displays the owners of your company, and traces them back – not to its ancestors, but to its “ultimate beneficial owners”, who must be not companies but natural persons. Between your company and the ultimate beneficial owners, every parent company must be indicated.

Don’t worry: you do not have to list each and every individual owner in this chart! Obviously, this would be a problem where there is a joint stock company somewhere along the way, or if a company simply has several owners. You only need to list owners with a share of at least 25% – surely there cannot be too many of them, right?

As a result, each branch of your chart must end either in the name of a natural person with an ownership percentage, or with a label “the rest of the owners; less than 25% each”.

Where to present the ownership structure?

You will be required to present the ownership structure of your Hungarian company to your mandatory Hungarian service providers:

- Your seat address provider

- Your bank

- Your accountant

Accordingly, it is best to present your ownership structure at the time of setting up your company, to ease the onboarding process at these providers. Moreover, the information you present to each must be the same to avoid future problems with the Tax Authority.

Please note: Presenting the ownership structure is not a requirement only at Helpers Finance. Every accountant is supposed to ask for this information. If your new accountant is not asking for this information, they are not doing a proper job.

Presenting the information

Presenting the ownership structure in the form of a chart not only makes you and your company look very professional: it also helps the clerk at the bank (or at the seat provider and your accountant) to record your data precisely.

In line with this: when you visit the bank, presenting your registration certificate and the articles of association of the direct parent company is not enough for the following reasons:

- Exact shares are not always listed, or not in an easily discernible fashion.

- Even if they are, such documents only provide information up to their “layer”, not necessarily on the ultimate beneficial owners.

- Even if they do, the clerk cannot be expected to spend time reading lengthy documents trying to extract information in the middle of the otherwise complex procedure; that could also be an excellent source of clerical errors.

On a similar note, simply listing the ultimate beneficial owners and their shares expressed in percentages is not enough. Every layer of parent companies must be indicated to your providers, and this is done easiest in a chart form.

Since data at your Hungarian bank can sometimes be modified in person, presenting your information in an easy to digest format lets you avoid the need for a correction later, which could cost you valuable time and effort.

Confidentiality and data security

Transparency of the ownership structure of every company is a basic requirement in the European Union. Business ownership is considered public information, and if you take a look at just the Hungarian Company Registry at e-cegjegyzek.hu, you will see that every owner of a company is listed by name. The ratio of the shares is recorded only at the above listed providers and the Hungarian Tax Authority. The information of the owners of parent companies is not public information and your providers are contractually required to treat it as confidential, so third parties cannot access it.

It can happen that at one of the parent companies in the chain of owners is confidential. That might be the case at high value companies, where the management or the subsidiary might even have an NDA in place to protect the identity of the owners. Unfortunately, since the transparency of the ownership structure of a company is non-negotiable in the EU, having such an entity in your chain of parent companies can jeopardize your European operation. To resolve that, you will need to ask for these owners’ consent to share their information, preferably even before the company is created. Otherwise, the Hungarian company cannot be set up with the same owners.

Report changes as soon as possible

Since transparency is such a basic requirement, changes to any point of the ownership chain must be reported as soon as possible. If you are not sure how to do that, start with your accountant and they can tell you how to proceed to keep the information up to date.

Let your accountants be your Helpers

The organizational structure of your Hungarian company should be transparent and easily traceable throughout a chain of intermediaries to the ultimate beneficial owner, who must be a natural person. The information you present to your seat address provider, your bank and your accountant must match in order to avoid future inconvenience.

Helpers Finance provides accounting services mostly to small and medium-sized company, with a focus on working with foreign owners. When we start your service, we will pay special attention to getting the ownership structure of your Hungarian company right and spare you any difficulty in the long run.

Was this article useful? Follow us on Facebook and never miss an update.

Contact

Get in touch today

Monday - Friday

9am - 5pm CET

Helpers Finance Kft.

Budapart Gate

Dombóvári út 27

Budapest 1117, Hungary

If you’re visiting us, please use entrance A and come to the 2nd floor.